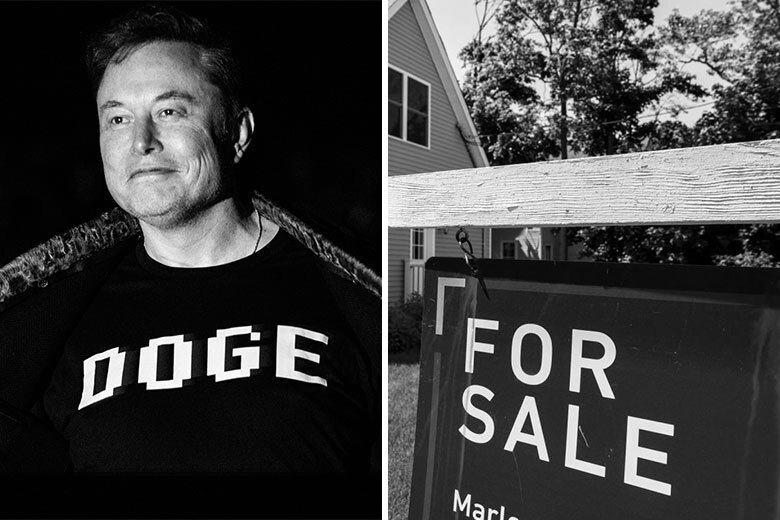

Melissa Harris had her future meticulously planned. But after more than 37 years in public service, those plans fell apart when President Donald Trump and Elon Musk’s Department of Government Efficiency (DOGE) ravaged her workplace at the National Institute of Health (NIH).

So Harris took an early retirement at the end of April, packed up her Gaithersburg, Md. home, and relocated to North Carolina.

“Right now, I can’t imagine anybody wanting to go to D.C. and live there,” she said.

Harris, 60, had planned to retire in two years so she could receive the maximum payout after about four decades of service. Instead, she expects she’ll be receiving less than what she would have, “even with the bonus that they offered,” she said. The day she came into the office to enjoy her early retirement celebration was the day mass firings hit NIH. Obviously, the party was cancelled. But DOGE’s blow to Harris was more than just symbolic. The unexpectedly rushed retirement pushed her to leave the area sooner than planned and buy a home in North Carolina before she had the chance to sell her Maryland property.

“[I] am paying for two homes until I get my other one fixed up to sell,” Harris said.

Two months later, Harris says she hasn’t been paid and isn’t sure when exactly she’ll receive her first check. “Nobody’s gotten in touch with me,” Harris said. “It’s kind of scary.”

The radio silence, she said, has forced Harris and her partner to cut costs amid the financial uncertainty.

“We just got a new house,” she said, “and we’re just going to pretend to be house poor for a while before we find out what’s going on.”

Stories such as Harris’ may turn out to be part of a trend that real estate experts are watching for closely: Public servants fired or otherwise impacted by DOGE cuts leaving the Beltway. In the DMV region, encompassing D.C., parts of Maryland, Virginia, and West Virginia, more than 500,000 people work directly for the federal government, according to data from the 2023 American Community Survey and 2025 Current Employment Statistics compiled by the Economic Policy Institute this year. These numbers don’t account for the vast network of external government contractors reliant on federal dollars. Massive job and contract cuts stand to alter the socioeconomic geography of the Beltway in a way the New York Times compared to the devastating impact of the collapse of manufacturing on the Midwest.

The complete picture of the number of workers who have lost their jobs as a result of the Trump administration’s “reduction-in-force” initiative is difficult to paint. About 75,000 workers took a buyout offer, Reuters reported in February, while more took the early retirement program Harris trusted most. In total, Reuters estimates that 260,000 federal workers were fired, accepted buyouts, or took early retirements.

They’re now struggling to find work, said Karen F. Lee of FedsForward. Her organization, launched after DOGE cuts started, helps federal workers transition to the private sector. “There are absolutely hardships,” she said, including people trying to afford camp for their kids this summer. “We’re at a place where, I think, there is absolutely worry.”

Newly jobless workers are afraid about making rent or not having healthcare. Some have dropped out of the labor force all together.

Paying for a home is another area being upended by the federal government shakeup.

A Bright MLS report released Tuesday surveyed DMV-area realtors in May and found nearly 40% of them said they’d had real estate transactions affected by federal government job cuts.

Specifically, the real estate agents in the D.C. metro area “said they have worked with a client whose decision to buy or sell was due to federal workforce layoffs and cuts,” according to the Bright MLS survey. Titled “Tracking the impact of DOGE on the housing market,” the report found, among other things, that retirees in the region like Harris were more likely to be home sellers, “suggesting that federal workforce cuts and uncertainty had a bigger impact on older workers in the D.C. metro area this spring.”

Sam Medvene is the president of the D.C. Association of Realtors and has seen the consequences of federal job loss in real time. Medvene said realtors in his association have worked with buyers who had to abruptly rescind contracts when their probationary government job offers were revoked.

“We had a lot of under-contract individuals lose jobs,” Medvene said.

The shakeups are also impacting sellers who wanted to sell their homes, came under contract, and then had those offers pulled because of the fallout from federal job loss.

“The combination of both the economic uncertainty and changes federally that are happening, as well as locally, has led to this retraction,” of buyer interest and an increase in inventory, said Medvene. For now, though, he said the situation is more wait-and-see than a dire retrenchment in the housing market.

May saw active listings in the D.C. metro area hit their highest level in four years, said Redfin senior economist Asad Khan. The region ranks in the top 10 among the 50 largest metro areas by active listings, Khan said.

There are signs that the area housing market is holding strong, but it’s on wobbly footing.

According to Bright MLS, younger families hit by DOGE layoffs and cuts may also be looking to leave the region, but may start the process later this year because of school and childcare.

That’s what DMV area realtor Richard Pearrell predicts. Pearrell maintains an online database tracking housing and condo inventory and average sales prices. On one hand, Pearrell sees panicked reports about federal layoffs as “hype,” and emphasized that the region still hasn’t returned to pre-pandemic levels of housing inventory. On the other hand, he acknowledged the toll economic uncertainty has taken especially on buyers.

“It’s just more of, ‘let’s sit back and wait until all of this irons itself out,’” Pearrell said. “‘Am I going to have a job or not? Or, is the spouse going to have a job or not?’ Those are the conversations I’m having.”

Noting that workers who took buyouts have months of runway before the rubber meets the road, Pearrell expects to see an uptick in people trying to sell their homes beginning as early as August.

“That’s when people are going to have to make the decision,” he said. “‘Well if I don’t have a job because I have taken the severance, what am I going to do?’”

And the D.C. metro area isn’t the only one that’ll be hit by the government’s job-slashing effort. Pearrell has seen the amount of homes for sale in Texas and Florida increasing “astronomically,” while fewer are being sold, creating a spike in housing inventory.

Mortgage broker and President-elect of the National Association of Mortgage Brokers, Kimber White, is based in Ft. Lauderdale and points to Florida as a hub for remote government workers who settled in the area during the COVID pandemic, and are being forced to return to Washington to comply with return-to-work mandates. He notes there’s been a slight uptick in mortgage delinquencies in the first part of 2025, but not enough to point to a crisis.

“Right now, no,” White said. “Do I think we’re going to see some [increases in delinquencies]? Yeah. We’re going to see an uptick,” he said.

For her part, Harris considers herself lucky. Though her lifelong service was cut short and retirement plans nearly thwarted, she was able to skip town and is settling down elsewhere. But what she faced at NIH still stings.

“Seeing the president and [Musk] on television, that affected us a lot,” Harris said. “Because seeing that, it’s almost like a personal attack… ‘You’re the problem.’ That’s what they’re saying.”